Freight Broker Factoring

As a freight broker, you’re the important liaison between shippers and motor carriers. You help manufacturers, wholesale distributors, farms, and food producers find the right trucks to transport their goods safely while also finding loads for trucking companies.

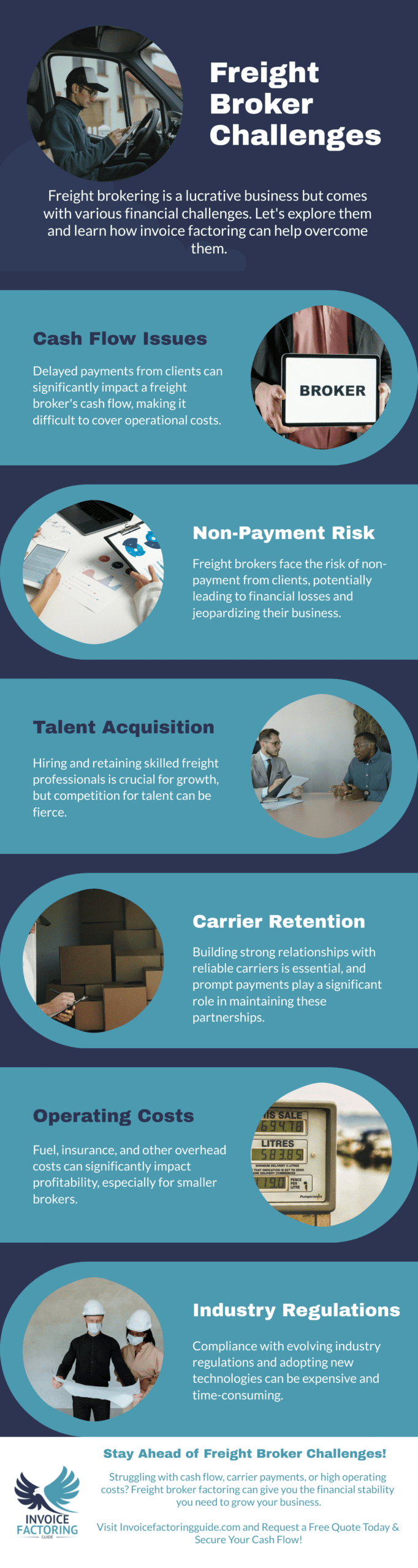

The relationships you support among these businesses are vital to keeping our economy moving. But with challenges like inconsistent cash flow, finding and retaining talent, and building a reliable carrier base, you need a financial solution that caters to your unique needs. That’s where freight broker factoring comes in—providing immediate cash flow, strengthening your operations, and helping you tackle the challenges of the freight brokerage industry.

Freight Brokers Factoring vs. Bank Loans

When it comes to financing your freight brokerage, you have a few options. Traditional bank loans may seem like a go-to choice, but they often come with strict credit requirements and lengthy approval times. Plus, they can put a strain on your business credit. On the other hand, freight broker factoring offers:

Top Financial Challenges in the Freight Broker Industry

Freight brokers face several unique challenges that need careful consideration:

How to Run a Successful Freight Brokerage Company

Running a successful freight brokerage requires a combination of industry expertise, strong client relationships, and smart financial management. Here are some tips to help you thrive:

Financing Options for Freight Brokers

As a freight broker, you have various financing options to help your business grow and overcome industry challenges:

By opting for invoice factoring for your freight brokerage, you can overcome the challenges of the industry and focus on growing your business, ensuring continued success in a competitive market.

Make an informed decision when choosing a freight factoring company to partner with by learning everything you need with this Factoring Guide.

Alternatively, contact the Invoice Factoring Guide (IFG) team today, and we will find the best freight broker factoring company for your needs. Request a complimentary rate quote now!

Factoring for Freight Brokers: How It Works and Why It Matters

In the fast-moving freight industry, cash flow is the backbone of a successful brokerage. Freight broker factoring services provide an efficient way to manage carrier payments, ensuring you have the working capital needed to pay trucking companies on time and grow your business. Instead of waiting 30 to 90 days for invoices to clear, factoring for freight brokers provides immediate funds, helping you stay ahead in a competitive market.

By working with the right factoring company, you gain access to flexible financing solutions tailored to your needs. Whether you’re an experienced broker or launching a new freight business, choosing the best factoring service can help your freight brokerage scale efficiently while maintaining financial stability.

How The Freight Broker Factoring Process Works

Understanding the freight factoring process is key to making informed financial decisions. Here’s how factoring works for freight brokers:

This process ensures steady cash flow, allowing brokers to cover carrier payment obligations, take on new freight loads, and focus on growing their business instead of chasing overdue invoices.

Choosing the Right Factoring Company for Your Brokerage

Finding the right factoring company is critical to maximizing the benefits of freight broker factoring. The best resources for freight brokers should include:

Why Freight Brokers Choose Factoring Services

Brokers use freight factoring services to:

By partnering with a trusted factoring service, brokers can stay competitive, reduce financial stress, and focus on expanding their operations. Whether you’re new to the industry or looking to scale, factoring for a freight brokerage can be the key to maintaining a profitable and efficient business.

Factoring Companies Chosen By Business Owners

“Our transition has been very smooth and easy.”

“Awesomeness personified. This company saved our business. Instead of having to wait around 2 months for our payments we get them within days.”

“I had a great experience from the onboarding to the factoring.”

“They give me the fast cash I need and the team there is great. My rep always takes the time to help me out.”

“I was completely impressed with their professionalism and customer service.”

“The people there really care about you and I’m very happy with the service I’ve gotten.”

Get an instant funding estimate

Results are estimates based on the calculated rate and the total invoice amount provided.

Actual rates may vary.

Request a Factoring Rate Quote

PREFER TO TALK? Call us at 1-844-887-0300

A Network Featured by the Media

Partners Affiliated with Industry Leaders